GOAL

BUILD A COMPREHENSIVE, DATA-DRIVEN INFRASTRUCTURE FOR ATTRACTING INVESTMENTS THAT EXPAND REVENUE DIVERSIFICATION, FUNDRAISING, AND ASSET ACQUISITION TO FURTHER STRENGTHEN THE UNIVERSITY’S FINANCIAL HEALTH AND CAPACITY.

INCREASE FINANCIAL SUSTAINABILITY

INTRODUCTION

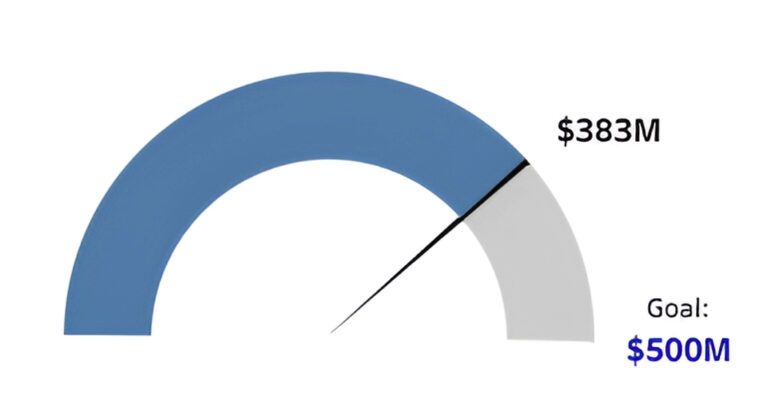

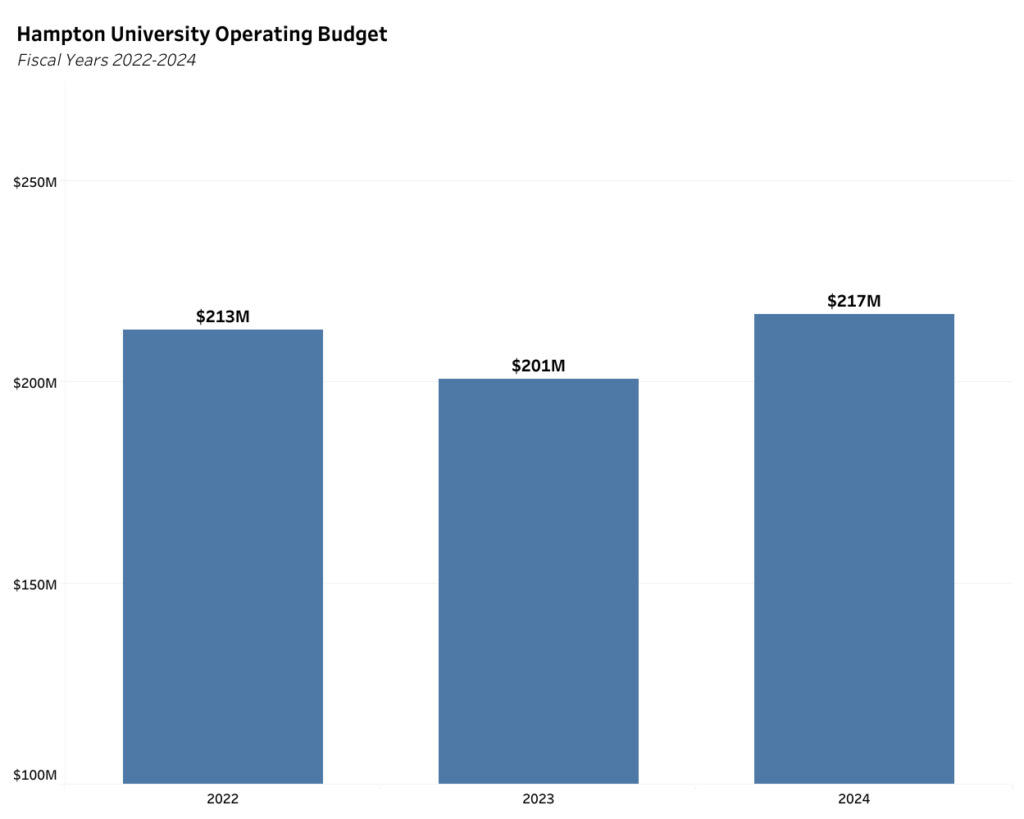

Hampton has been fortunate to build a sterling reputation and solid fiscal foundation over the decades. However, contemporary students require a more attentive and sophisticated experience than previous generations. To that end, central to delivering the #1 Student Experience in America is a commitment to increasing the University’s operational excellence. This plan establishes lofty goals and priorities. To realize its goals, tremendous expansion in the external investment in the University will be required. Through sound, time-honored, and research-based principles, Hampton will apply superior judgment as it discerns the appropriate strategies for fundraising success and attaining the $1 billion endowment goal. This plan is the beginning phase of planning a global capital campaign.

GOAL

BUILD A COMPREHENSIVE, DATA-DRIVEN INFRASTRUCTURE FOR ATTRACTING INVESTMENTS THAT EXPAND REVENUE DIVERSIFICATION, FUNDRAISING, AND ASSET ACQUISITION TO FURTHER STRENGTHEN THE UNIVERSITY’S FINANCIAL HEALTH AND CAPACITY.

INTRODUCTION

Hampton has been fortunate to build a sterling reputation and solid fiscal foundation over the decades. However, contemporary students require a more attentive and sophisticated experience than previous generations. To that end, central to delivering the #1 Student Experience in America is a commitment to increasing the University’s operational excellence. This plan establishes lofty goals and priorities. To realize its goals, tremendous expansion in the external investment in the University will be required. Through sound, time-honored, and research-based principles, Hampton will apply superior judgment as it discerns the appropriate strategies for fundraising success and attaining the $1 billion endowment goal. This plan is the beginning phase of planning a global capital campaign.

STRATEGIES AND KEY PERFORMANCE INDICATORS

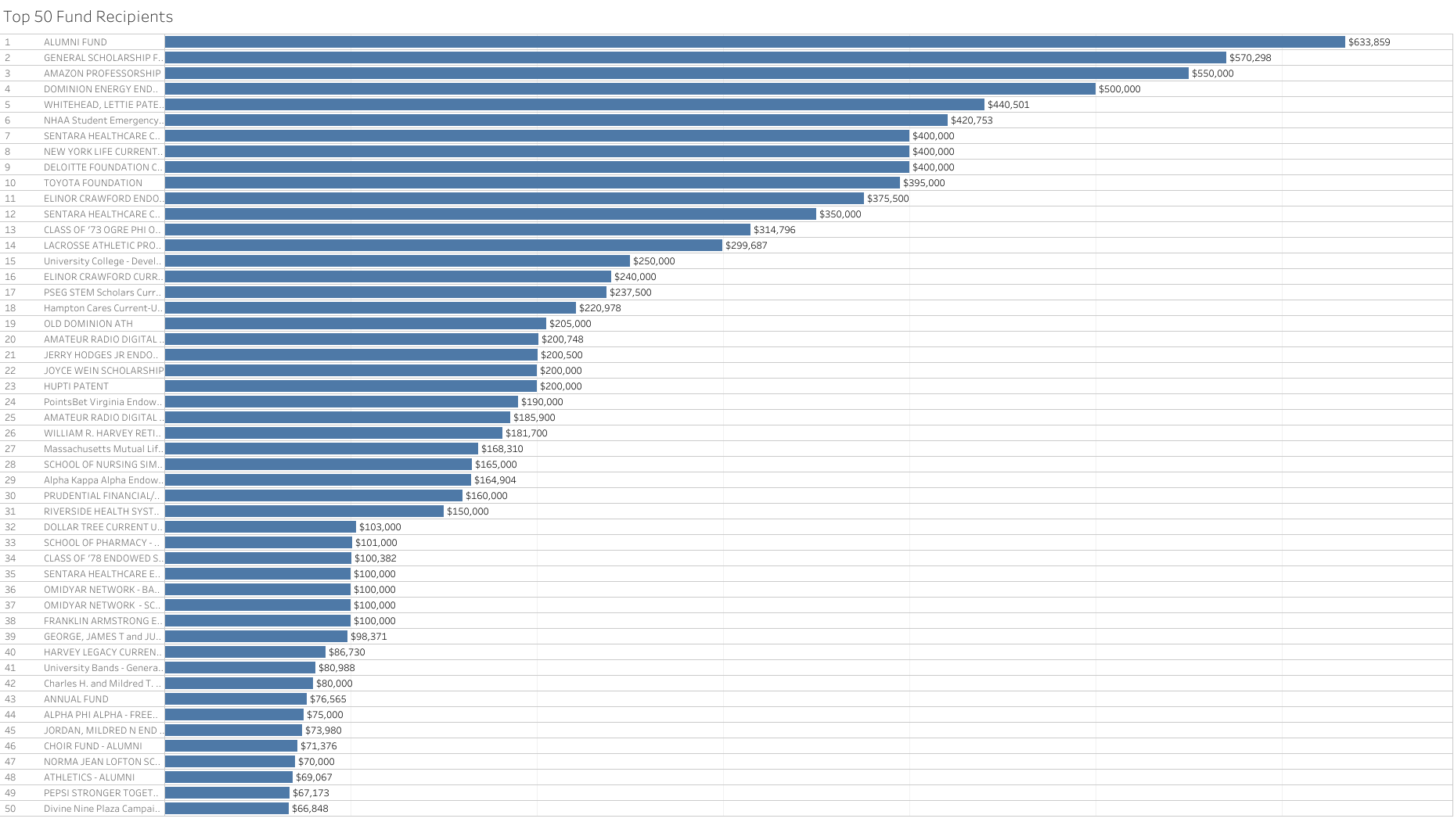

4.1 Enhance Hampton’s financial position by diversifying revenue sources and strengthening institutional relationships with donors, parents, students, corporations, foundations, governments, and alumni.

4.2 Recruit, retain and resource a credential high-performing fundraising team that employs data driven decision making to realize the University’s loftiest fundraising goals.

4.3 Elevate the role of members of the Board of Trustees in the fundraising efforts of the university to include assisting with: identification, cultivation, solicitation, and stewardship of campaign donors.

4.4 Advance the University’s aspiration to achieve R1 designation by aggressively aligning internal policies, procedures, protocols, and priorities with best practices and appropriate sensitivity to Hampton’s role, scope, and mission as a private HBCU in a way that increases the commercialization of research and innovation conducted by Hampton faculty, students and scholar-practitioners.

4.5 Develop a comprehensive economic development agenda for Hampton that provides fiscal, physical, and social benefit to both the University and region.

4.6 Develop a data-driven enrollment management plan that provides expanded fiscal support to the University.

STRATEGIES AND KEY PERFORMANCE INDICATORS

Key Performance Indicators

a. Complete a comprehensive development assessment to identify Hampton University’s fundraising capacity.

b. Develop a comprehensive naming campaign.

c. Develop a comprehensive corporate and foundation relations structure and strategy.

d. Synchronize stewardship activity across the campus.

e. Implement a data-driven prospect management system.

f. Expand and enhance research facilities, augment support for research administration, target start-up and seed funding to promising research faculty.

g. Increase mobile, text and online giving options.

h. Increase the percent of recurring donors to an industry leading standard.

i. Make fundraising events cost neutral.

j. Increase the number of gifts secured by 7% annually above baseline.

k. Increase the average gift size by 7% annually above baseline.

l. Review current investment strategy and determine appropriate risk level.

m. Identify fund managers who will support Hampton’s aspirations.

n. Incorporate goal into all fundraising communications and cultivation efforts.

Key Performance Indicators

a. Reduce the cost per dollar raised to an industry leading standard.

b. Reduce donor acquisition cost to an industry leading standard.

c. Improve donor retention rate.

d. Improve the University’s conversion rate.

e. Upgrade the annual giving structure to increase small donor participation that can be matured into major gifts.

f. Upgrade the planned giving structure and effort to increase legacy gifts.

g. Increase synchronicity between development, research, and government relations.

Key Performance Indicators

a. Provide/deliver leaders for capital campaign.

b. Increase the collective annual giving of the Hampton University Board of Trustees

c. Increase the number of quality donor prospects presented by each Trustee.

d. Increase the number of cultivation visits conducted.

e. Increase the number of President introductions conducted

Key Performance Indicators

a. Identify mentoring R1 institution and schedule a meeting to identify tactical steps.

b. Analyze current administrative practices to identify barriers to progress.

c. Benchmark current and exemplary research practices.

Key Performance Indicators

a. Gauge current economic development efforts through discussions with Virginia Peninsula Chamber of Commerce, Virginia Economic Development Partnership, Virginia Economic Developers Association, Virginia International Business Council and Lead Virginia.

b. Identify current research and service activities within faculty with emphasis on business, political, and education faculty.

c. Develop strategies to demonstrate Hampton University’s economic contribution and impact.

Key Performance Indicators

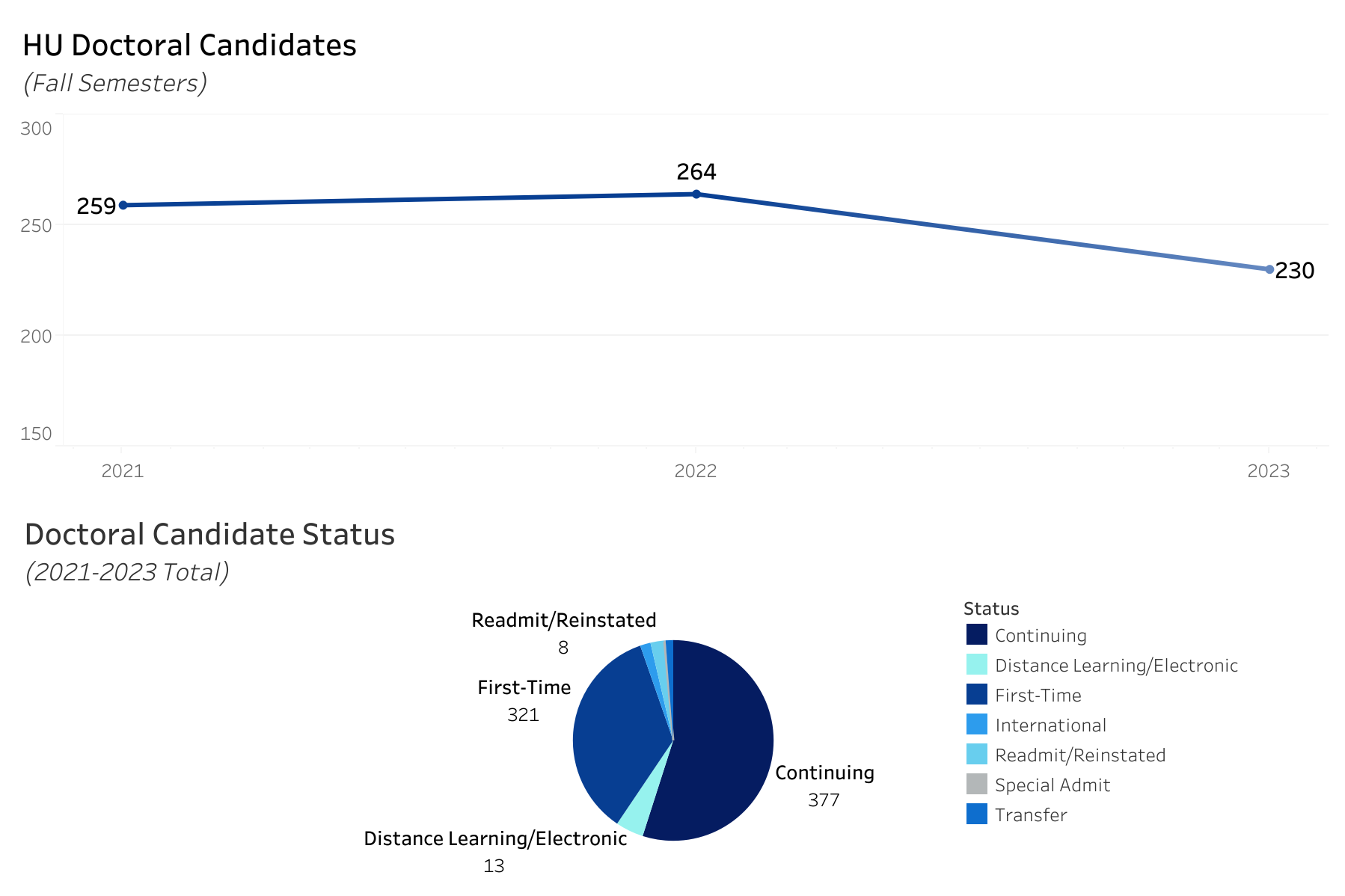

a. Gauge current student retention levels for each student classification.

b. Assess challenges unique to each group and address them.

c. Establish a fiscal baseline and monitor progress as retention practices are implemented.

d. Expand Hampton’s inventory of stackable micro-credentials that seamlessly transition into HU degree programs.

4.1 Enhance Hampton’s financial position by diversifying revenue sources and strengthening institutional relationships with donors, parents, students, corporations, foundations, governments, and alumni.

Key Performance Indicators

a. Complete a comprehensive development assessment to identify Hampton University’s fundraising capacity.

b. Develop a comprehensive naming campaign.

c. Develop a comprehensive corporate and foundation relations structure and strategy.

d. Synchronize stewardship activity across the campus.

e. Implement a data-driven prospect management system.

f. Expand and enhance research facilities, augment support for research administration, target start-up and seed funding to promising research faculty.

g. Increase mobile, text and online giving options.

h. Increase the percent of recurring donors to an industry leading standard.

i. Make fundraising events cost neutral.

j. Increase the number of gifts secured by 7% annually above baseline.

k. Increase the average gift size by 7% annually above baseline.

l. Review current investment strategy and determine appropriate risk level.

m. Identify fund managers who will support Hampton’s aspirations.

n. Incorporate goal into all fundraising communications and cultivation efforts.

4.2 Recruit, retain and resource a credential high-performing fundraising team that employs data driven decision making to realize the University’s loftiest fundraising goals.

Key Performance Indicators

a. Reduce the cost per dollar raised to an industry leading standard.

b. Reduce donor acquisition cost to an industry leading standard.

c. Improve donor retention rate.

d. Improve the University’s conversion rate.

e. Upgrade the annual giving structure to increase small donor participation that can be matured into major gifts.

f. Upgrade the planned giving structure and effort to increase legacy gifts.

g. Increase synchronicity between development, research, and government relations.

4.3 Elevate the role of members of the Board of Trustees in the fundraising efforts of the university to include assisting with: identification, cultivation, solicitation, and stewardship of campaign donors.

Key Performance Indicators

a. Provide/deliver leaders for capital campaign.

b. Increase the collective annual giving of the Hampton University Board of Trustees

c. Increase the number of quality donor prospects presented by each Trustee.

d. Increase the number of cultivation visits conducted.

e. Increase the number of President introductions conducted

4.4 Advance the University’s aspiration to achieve R1 designation by aggressively aligning internal policies, procedures, protocols, and priorities with best practices and appropriate sensitivity to Hampton’s role, scope, and mission as a private HBCU in a way that increases the commercialization of research and innovation conducted by Hampton faculty, students and scholar-practitioners.

Key Performance Indicators

a. Identify mentoring R1 institution and schedule a meeting to identify tactical steps.

b. Analyze current administrative practices to identify barriers to progress.

c. Benchmark current and exemplary research practices.

4.5 Develop a comprehensive economic development agenda for Hampton that provides fiscal, physical, and social benefit to both the University and region.

Key Performance Indicators

a. Gauge current economic development efforts through discussions with Virginia Peninsula Chamber of Commerce, Virginia Economic Development Partnership, Virginia Economic Developers Association, Virginia International Business Council and Lead Virginia.

b. Identify current research and service activities within faculty with emphasis on business, political, and education faculty.

c. Develop strategies to demonstrate Hampton University’s economic contribution and impact.

4.6 Develop a data-driven enrollment management plan that provides expanded fiscal support to the University.

Key Performance Indicators

a. Gauge current student retention levels for each student classification.

b. Assess challenges unique to each group and address them.

c. Establish a fiscal baseline and monitor progress as retention practices are implemented.

d. Expand Hampton’s inventory of stackable micro-credentials that seamlessly transition into HU degree programs.

INCREASE FINANCIAL SUSTAINABILITY

GOAL

BUILD A COMPREHENSIVE, DATA-DRIVEN INFRASTRUCTURE FOR ATTRACTING INVESTMENTS THAT EXPAND REVENUE DIVERSIFICATION, FUNDRAISING, AND ASSET ACQUISITION TO FURTHER STRENGTHEN THE UNIVERSITY’S FINANCIAL HEALTH AND CAPACITY.

INTRODUCTION

Hampton has been fortunate to build a sterling reputation and solid fiscal foundation over the decades. However, contemporary students require a more attentive and sophisticated experience than previous generations. To that end, central to delivering the #1 Student Experience in America is a commitment to increasing the University’s operational excellence. This plan establishes lofty goals and priorities. To realize its goals, tremendous expansion in the external investment in the University will be required. Through sound, time-honored, and research-based principles, Hampton will apply superior judgment as it discerns the appropriate strategies for fundraising success and attaining the $1 billion endowment goal. This plan is the beginning phase of planning a global capital campaign.

STRATEGIES AND KEY PERFORMANCE INDICATORS

Key Performance Indicators

a. Complete a comprehensive development assessment to identify Hampton University’s fundraising capacity.

b. Develop a comprehensive naming campaign.

c. Develop a comprehensive corporate and foundation relations structure and strategy.

d. Synchronize stewardship activity across the campus.

e. Implement a data-driven prospect management system.

f. Expand and enhance research facilities, augment support for research administration, target start-up and seed funding to promising research faculty.

g. Increase mobile, text and online giving options.

h. Increase the percent of recurring donors to an industry leading standard.

i. Make fundraising events cost neutral.

j. Increase the number of gifts secured by 7% annually above baseline.

k. Increase the average gift size by 7% annually above baseline.

l. Review current investment strategy and determine appropriate risk level.

m. Identify fund managers who will support Hampton’s aspirations.

n. Incorporate goal into all fundraising communications and cultivation efforts.